The very nature of the digital asset industry makes it hard to know exactly how many people participate in the digital economy, which assets they favor, or why they got into digital assets to begin with.

Well, we wanted answers. We asked Markteffect to perform market research on digital asset adoption, and they surveyed over a thousand individuals each in the Netherlands, Belgium, and Germany, to gather insights about the state of digital assets.

We know that like us, many of you are interested in following and understanding the development of our industry, and so we’re proud to present some of the most interesting data points we’ve discovered:

How many people own or are thinking about owning digital assets?

Perhaps the holy grail of digital asset adoption questions, we simply wanted to know how many people currently own or are thinking of investing in digital assets.

About 16% of Germans surveyed indicated they own or are thinking about investing in digital assets, compared to 12% in the Netherlands and in Belgium. In absolute numbers, we estimate that a little over 13 million Germans own or are considering digital assets, as well as 2 million Dutch and 1.4 million Belgians. Quite impressive.

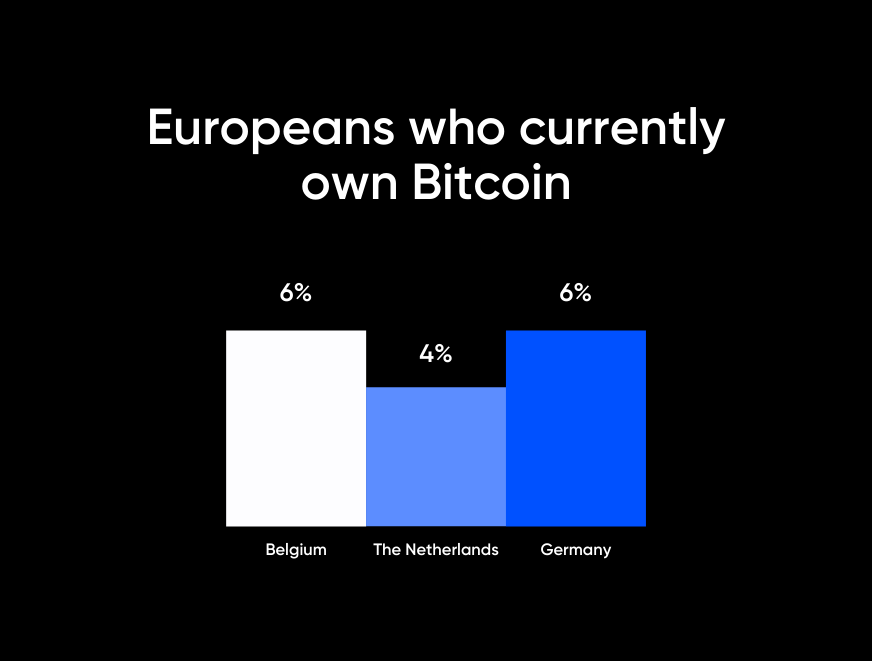

Which digital asset is the most popular?

Unsurprisingly, Bitcoin is the most held digital asset in all three countries. An estimated 6% of Germans and Belgians own Bitcoin, compared to 4% of the Dutch. This means that 4 million Germans own Bitcoin, while 600K Dutch and half a million Belgians are similarly hodling.

When asked to spontaneously name a digital asset, 64% of respondents were able to come up with Bitcoin. Ethereum and Dogecoin are far behind with 9% and 8%, respectively. While Bitcoin has achieved mainstream popularity, Ethereum, which is as widely known as Bitcoin in crypto communities, isn’t quite there yet.

Why do people invest (or don’t invest) in digital assets?

Naturally, we were also interested to understand what drove people to and away from digital assets.

39% of Dutch people, 37% of Belgians, and 28% of Germans cited a lack of knowledge as the primary barrier to investing in digital assets. Risk concerns came in at #2 for Dutch and Belgians, and #3 for Germans.

The leading driver of digital asset adoption in all three countries is - once again, unsurprisingly - the expected return on investment. Expected returns is the primary reason people invest in general, so while historical digital asset returns are enticing, this isn’t a unique phenomenon.

How many people used to own Bitcoin, but don’t anymore?

Think of this one as the Bitcoin churn, if you will. People who once invested in Bitcoin but decided to sell and don’t own Bitcoin at the time of the survey. In Germany, 20% of current non-holders used to own Bitcoin. This figure is relatively high, compared to 11% in Belgium and 8% in the Netherlands.

The other side of this coin are people who never invested in Bitcoin but admit that they are tempted to. Once again, Germany leads with 23% of the non-Bitcoin holders considering an investment, followed by 18% and 17% of Dutch and Belgians non-holders, respectively.

Finally, how many people agree that Bitcoin should be banned?

Every once in a while, a prominent politician or economist proposes to ban Bitcoin for one reason or another. We were interested to know how this sentiment resonates with the general public in all three countries.

In Germany, 74% of respondents disagreed that Bitcoin should be banned. In the Netherlands and Belgium, 71% are against a Bitcoin ban.

Looking Forward

This survey will be conducted again in October in order to follow the latest developments and sentiment changes in these three countries. If you would like to receive our full research paper, please send us an email at press@bitvavo.com.

Make sure to bookmark Bitvavo Magazine and follow our Twitter and Facebook for our latest updates and research.